2025 Arizona State Tax Brackets - The arizona state tax calculator (azs tax calculator) uses the latest federal tax tables and state tax tables for 2025/25. Your 2023 individual income tax return is due by midnight on april 15, 2025.

The arizona state tax calculator (azs tax calculator) uses the latest federal tax tables and state tax tables for 2025/25.

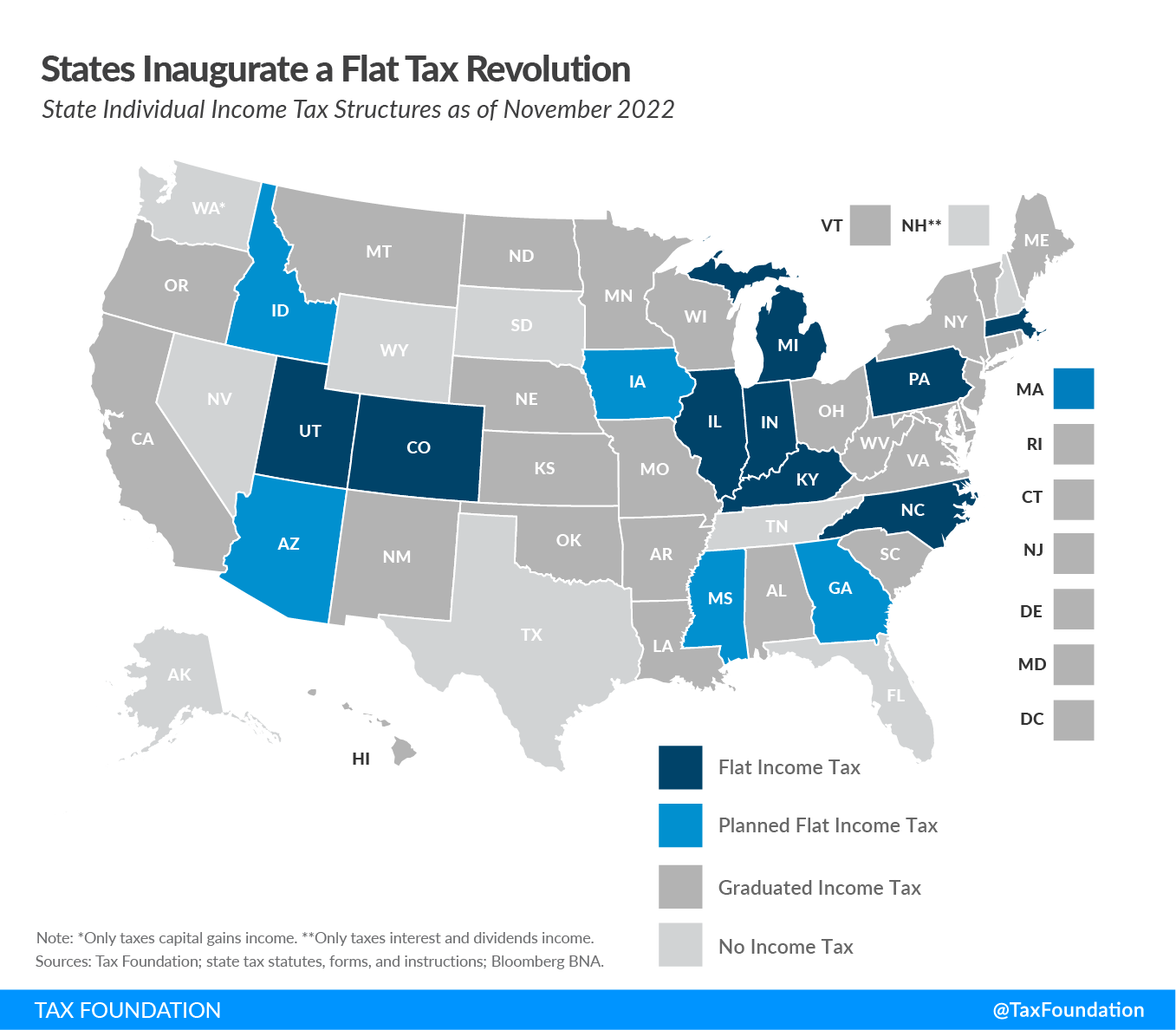

2025 Arizona State Tax Brackets. To estimate your tax return for 2025/25, please select. In 2023, the state transitioned to its current flat tax rate of 2.5%, which applies to taxes filed in 2025.

2025 Standard Deductions And Tax Brackets Helene Kalinda, Arizona’s income tax for the year 2023 (filed by april. Seven states levy no individual income tax at all.

2025 Irs Tax Rates And Brackets Fanya Crissie, This tool is freely available and is designed to help you. Top marginal rates span from arizona ’s and north dakota ’s 2.5 percent to california ’s 13.3 percent.

Tax Brackets 2025 Irs Single Elana Harmony, The due dates for your state income tax return. There are seven federal income tax brackets for 2023 and 2025.

Arizona state offers tax deductions and credits to reduce your tax liability, including a standard and itemized deductions.

Tax Brackets 2025 Arizona State Cele Meggie, Explore the latest corporate income tax rates by state with our 2025 corporate tax rates map. Arizona income tax brackets and rates:

Arizona State Tax Brackets 2025 Aline Beitris, 2025 tax calculator for arizona. (california also imposes a 1.1 percent payroll tax on wage.

This tool is freely available and is designed to help you. 2023 state tax filing deadline:

Irs New Tax Brackets 2025 Elene Hedvige, Arizona income tax brackets and rates: 2025 federal income tax brackets and rates.

Arizona State Tax Withholding Form 2023 Printable Forms Free Online, Arizona state offers tax deductions and credits to reduce your tax liability, including a standard and itemized deductions. Arizona consolidated its four income tax brackets into two brackets in 2025.